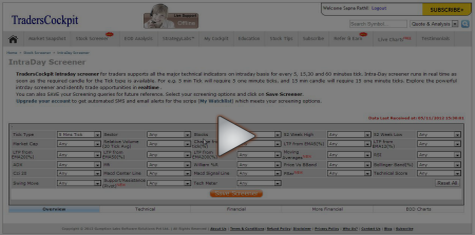

Tick Type RealTime 1 Day Tick Weekly Tick Monthly Tick Sector

Any

Agro

Air Conditioners

Aluminium

Appliances

Auto

Auto Ancl

Banks - Private

Banks - PSU

Beverages

Cables

Castings

Cement

Ceramics

Chemicals

Cigarettes

Coke

Commodities

Compressors

Computers

Construction

Consumer Goods

Couriers

Cycles

Diversified

Dry Cells

Dyes

Edible Oils

Electric

Electronics

Engineering

Engines

Entertainment

Fertilisers

Finance

FMCG

Food Processing

Gas

Glass

Grinding Wheels

Hotels

Infrastructure

Jewellery

Leather

Medical

Metals

Mining

Misc

Oil Drilling

Packaging

Paints

Paper

Petrochem

Pharmaceuticals

Plastics

Power

Printing

Refineries

Retail

Shipping

Steel

Sugar

Tea-Coffee

Telecom

Textiles

Trading

Transport

Travel

Stocks Any Only Futures and Options Non Futures and Options Nifty 50 Stocks NIFTY NEXT 50 NIFTY 100 NIFTY 200 NIFTY 500 NIFTY MIDCAP 100 Nifty Midcap 50 NIFTY SMALL 100 NIFTY Auto Bank Nifty NIFTY Energy NIFTY FIN SERVICE NIFTY FMCG NIFTY IT NIFTY MEDIA NIFTY METAL NIFTY MNC NIFTY Pharma NIFTY PSU BANK NIFTY Realty NIFTY Commodities NIFTY Consumption NIFTY Infra NIFTY PSE NIFTY SERV SECTOR NIFTY100 LIQ 15 NIFTY GROWSECT 15 NIFTY50 VALUE 20 Nifty MID100 Free Nifty SML100 Free 52 Week High Any is 52 High week High 0.1% or less below high 0.25% or less below high 0.5% or less below high 1% or less below high 5% or less below high 10% or less below high 20% or less below high 30% or less below high 40% or less below high 50% or less below high 60% or less below high 70% or less below high 80% or less below high 90% or less below high 95% or less below high 99% or less below high Between 9% and 14.6 % (below 52week high) Between 14.6 % and 23.6 (below 52week high) Between 23.6 % and 38.2 (below 52week high) Between 38.2 % and 50 (below 52week high) Between 50 % and 61.8 (below 52week high) Between 61.8 % and 78.6 (below 52week high) 78.6% below 52week high 52 Week Low Any is 52 High week Low 0.1% or less above low 0.25% or less above low 0.5% or less above low 1% or less above low 5% or less above low 10% or less above low 20% or less above low 30% or less above low 40% or less above low 50% or less above low 60% or less above low 70% or less above low 80% or less above low 90% or less above low 95% or less above low 99% or less above low is 52 High week Low Between 9% and 14.6 % (above 52week low) Between 14.6 % and 23.6 % (above 52week low) Between 23.6% and 38.2 % (above 52week low) Between 38.2% and 50 % (above 52week low) Between 50% and 61.8 % (above 52week low) Between 61.8% and 78.6 % (above 52week low) Between 78.6% and 100 % (above 52week low) Between 100% and 161.8 % (above 52week low) Between 161.8% and 200 % (above 52week low) 261.8% above 52week low 400% above 52week low

Relative Volume (20 Day Avg) Any Over 0.5x Over 0.75x Over 1x Over 1.25 x Over 1.5 x Over 1.75 x Over 2x Over 3x Over 4x Over 5x Over 10x Below 1x Below 1.5x Below 2x Below 3x Below 5x Below 10x Change from last tick(%) Any Up > 0 Up > 0.5% Up > 1% Up > 1.5% Up > 2% Up > 1% and < 2% Up > 0.5% and < 2% Down > 0.5% and < 2% Up > 3% Up > 5% Up > 10% Up > 15% Up > 20% Up < 1.2% and > -1.2% Down < 0 Down > 0.5% Down > 1% Down > 1.5% Down > 2% Down > 1% and < 2% Down > 3% Down > 5% Down > 10% Down > 15% Down > 20% LTP from EMA5(%) Any Price is below EMA 5 Price is above EMA 5 Price is below -20% Price is below -10% Price is below -5% Price is below -1% Price is below -0.5% Price is between 0 to -5% Price is between 0 to 5% Price is between 0 to -2% Price is between 0 to 2% Price is between 0.5 to -0.5% Price is above 0.5% Price is above 1% Price is above 5% Price is above 10% Price is above 20% LTP from EMA12(%) Any Price is below EMA 12 Price is above EMA 12 Price is below -20% Price is below -10% Price is below -5% Price is below -1% Price is below -0.5% Price is between 0 to -5% Price is between 0 to 5% Price is between 0 to -2% Price is between 0 to 2% Price is between 0.5 to -0.5% Price is above 0.5% Price is above 1% Price is above 5% Price is above 10% Price is above 20% LTP from EMA20(%) Any Price is below EMA 20 Price is above EMA 20 Price is below -20% Price is below -10% Price is below -5% Price is below -1% Price is below -0.5% Price is between 0 to -5% Price is between 0 to 5% Price is between 0 to -2% Price is between 0 to 2% Price is between 0.5 to -0.5% Price is above 0.5% Price is above 1% Price is above 5% Price is above 10% Price is above 20%

LTP from EMA50(%) Any Price is below EMA 50 Price is above EMA 50 Price is below -20% Price is below -10% Price is below -5% Price is below -1% Price is below -0.5% Price is between 0 to -5% Price is between 0 to 5% Price is between 0 to -2% Price is between 0 to 2% Price is between 0.5 to -0.5% Price is above 0.5% Price is above 1% Price is above 5% Price is above 10% Price is above 20% LTP from EMA200(%) Any Price is below EMA 200 Price is above EMA 200 Price is below -20% Price is below -10% Price is below -5% Price is below -1% Price is below -0.5% Price is between 0 to -5% Price is between 0 to 5% Price is between 0 to -2% Price is between 0 to 2% Price is between 0.5 to -0.5% Price is between 1 to -1% Price is above 0.5% Price is above 1% Price is above 5% Price is above 10% Price is above 20% Price crossing EMA200 From Below Price crossing EMA200 From Above Moving Averages Any Price moving above EMA5(Bullish) Price moving above EMA12(Bullish) Price moving above EMA20(Bullish) Price moving above EMA50(Bullish) Price moving below EMA5(Bearish) Price moving below EMA12(Bearish) Price moving below EMA20(Bearish) Price moving below EMA50(Bearish) Ema 5 crossing Ema 12 from below(Bullish) Ema 5 crossing Ema 12 from above(Bearish) Ema 12 crossing Ema 20 from below(Bullish) Ema 12 crossing Ema 20 from above(Bearish) Ema 20 crossing Ema 50 from below(Bullish) Ema 20 crossing Ema 50 from above(Bearish) Ema 5 crossing Ema 50 from below(Bullish) Ema 5 crossing Ema 50 from above(Bearish) Ema 5 crossing Ema 20 from below(Bullish) Ema 5 crossing Ema 20 from above(Bearish) Ema 12 crossing Ema 50 from below(Bullish) Ema 12 crossing Ema 50 from above(Bearish) Ema 50 crossing Ema 200 from below(Bullish) Ema 50 crossing Ema 200 from above(Bearish) Price moving above 5,12,and 20 Ema (Bullish) Price moving below 5,12,and 20 Ema (Bearish) Price is above 12,20,50,200 EMA Price is below 12,20,50,200 EMA 20 EMA > Price > 50 EMA > 200 EMA 20 EMA < Price < 50 EMA < 200 EMA Price >5 EMA > 20 EMA 20 EMA > 5 EMA > Price 5 EMA > Price > 20 EMA Price >5 EMA > 50 EMA 50 EMA > 5 EMA > Price 5 EMA > Price > 50 EMA Price >20 EMA > 50 EMA 50 EMA > 20 EMA > Price 20 EMA > Price > 50 EMA 5 EMA < 20 EMA < Price Price < 20 EMA < 5 EMA 5 EMA < Price < 20 EMA 5 EMA < 50 EMA < Price Price < 50 EMA < 5 EMA 5 EMA < Price < 50 EMA 20 EMA < 50 EMA < Price Price < 50 EMA < 20 EMA 20 EMA < Price < 50 EMA Price < 5 EMA < 20 EMA Price is below 5 and 20 EMA Price is above 5 and 20 EMA 20 EMA >50 EMA > 200 EMA 50 EMA > 200 EMA Close > 20 EMA and 20 EMA >50 EMA > 200 EMA Close >50 EMA 50 EMA > 200 EMA 20 EMA <50 EMA < 200 EMA 50 EMA < 200 EMA Close < 20 EMA and 20 EMA <50 EMA < 200 EMA Close <50 EMA 50 EMA < 200 EMA 50 EMA > 200 EMA and low<50EMA 20 EMA > 50 EMA and low<20EMA 50 EMA < 200 EMA and high>50EMA 20 EMA < 50 EMA and high>20EMA Price crossing SMA 5 from below(Bullish) Price crossing SMA 5 from above(Bearish) Price crossing SMA 12 from below(Bullish) Price crossing SMA 12 from above(Bearish) Price crossing SMA 20 from below(Bullish) Price crossing SMA 20 from above(Bearish) Price crossing SMA 50 from below(Bullish) Price crossing SMA 50 from above(Bearish) Price crossing SMA 200 from below(Bullish) Price crossing SMA 200 from above(Bearish) RSI Any OverBought (> 90) OverBought (> 80) OverBought (> 75) OverBought (> 70) Above 65 Above 60 Above 50 Above 30 Above 25 Below 75 Below 70 Below 50 Below 40 Below 35 OverSold (< 30) OverSold (< 25) OverSold (< 20) OverSold (< 10) Between 10 and 20 Between 20 and 30 Between 30 and 40 Between 30 and 70 Between 40 and 60 Between 60 and 70 Between 70 and 80 Between 80 and 90 Above previous tick Below previous tick Crossed above 20 (Bullish) Crossed above 30 (Bullish) Crossed above 40 Crossed above 50 Crossed above 55 Crossed above 60 Crossed above 70 Crossed above 80 Crossed below 20 Crossed below 30 Crossed below 40 Crossed below 50 Crossed below 55 Crossed below 60 Crossed below 70 (Bearish) Crossed below 80 (Bearish) ADX Any Trending (> 80) Trending (> 60) Trending (> 50) Trending (> 40) Trending (> 30) Trending (> 25) Trending (> 20) ADX > 15 ADX < 25 ADX < 30 Range Bound (< 20) Range Bound (< 10) ADX Increasing ADX Decreasing ADX above 16 AND Increasing ADX crossing Minus Di from Above ADX crossing Minus Di from Below ADX crossing Plus Di from Above ADX crossing Plus Di from Below ADX > Plus Di ADX > Minus Di ADX < Plus Di ADX < Minus Di ADX between 15 and 20 ADX between 20 and 25 ADX between 25 and 30 ADX between 35 and 40 ADX between 45 and 50 ADX between 10 and 20 ADX between 20 and 30 ADX between 30 and 40 ADX between 40 and 50 ADX between 50 and 60 ADX between 60 and 70 ADX between 70 and 80

Mfi Any OverBought (> 90) OverBought (> 80) Above 75 Above 70 Above 65 Above 60 Above 50 Above 30 Above 25 Above 20 Below 75 Below 70 Below 50 Below 40 Below 30 Below 25 OverSold (< 20) OverSold (< 10) Between 10 and 20 Between 20 and 30 Between 30 and 40 Between 30 and 70 Between 40 and 70 Between 60 and 70 Between 70 and 80 Between 80 and 90 MFI Increasing MFI Decreasing Crossed above 20 (Bullish) Crossed above 30 Crossed above 40 Crossed above 50 Crossed above 60 Crossed above 70 Crossed above 80 Crossed below 20 Crossed below 30 Crossed below 40 Crossed below 50 Crossed below 60 Crossed below 70 Crossed below 80 (Bearish) William %R Any William%R Increasing William%R Decreasing OverBought (> -5) OverBought (> -10) OverBought (> -20) Above -30 Below -70 OverSold (< -80) OverSold (< -90) OverSold (< -95) Between -30 and -70 Between -20 and -80 Below -20 Above -80 Crossed Above -10 Crossed Above -20 Crossed Above -30 Crossed Above -40 Crossed Below -90 Crossed Below -80 Crossed Below -70 Crossed Below -60 Crossed Below -10 Crossed Below -20 (Bearish) Crossed Below -30 Crossed Below -40 Crossed Above -90 Crossed Above -80 (Bullish) Crossed Above -70 Crossed Above -60 Between 0 and -10 Between -10 and -20 Between -20 and -30 Between -30 and -40 Between -40 and -50 Between -50 and -60 Between -60 and -70 Between -70 and -80 Between -80 and -90 Between -90 and -100 Bollinger Band(%) Any Narrowing (< 0.25%) Narrowing (< 0.50%) Narrowing (< 0.75%) Narrowing (< 1%) Narrowing (< 2%) Narrowing (< 5%) Narrowing (< 10%) Narrowing (< 25%) Widening (> 15%) Widening (> 20%) Widening (> 25%) Price Vs BBand Any Price above upper band Price below lower band High Price above upper band Low Price below lower band Price nearing upper band from below(< 2%) Price nearing lower band from above (< 0.5%) Price nearing upper band from below(< 0.5%) Price nearing lower band from above (< 2%) Price nearing lower band from above (> 2.02%) Price crossed above upper bollinger band (from below) Price crossed below upper bollinger band (from above) -BEARISH Price crossed above lower bollinger band (from below) - BULLISH Price crossed below lower bollinger band (from above) High crossed below upper bollinger band (from above) -BEARISH Low crossed above lower bollinger band (from below) - BULLISH Open is below Lower bollinger Band Open is above Upper bollinger Band High is below Lower bollinger Band Low is above Upper bollinger Band Body is above Upper bollinger Band Body is below Lower bollinger Band Price is above bollinger middle band Price is below bollinger middle band Open is below bollinger middle Band Open is above bollinger middle Band High is below bollinger middle Band Low is above bollinger middle Band Body is above bollinger middle Band Body is below bollinger middle and Cci 20 Any CCI Increasing CCI Decreasing OverBought (> 200) OverBought (> 150) OverBought (> 100) OverSold (< -100) OverSold (< -150) OverSold (< -200) Between 0 and 100 Between 0 and -100 Between 100 and -100 Below 100 Above -100 Crossed Above -200 (Bullish) Crossed Above -100 (Bullish) Crossed Above 0 Crossed Above 100 Crossed Above 200 Crossed Above 235 Above 235 Above -235 Crossed Below -200 Crossed Below -100 Crossed Below 0 Crossed Below 100 (Bearish) Crossed Below 200 (Bearish) Below 200 Above -200 Between -100 and -200 Between 100 and 200

Macd Center Line Any Macd moving above zero (Bullish) Macd moving below zero (Bearish) Macd is above zero Macd is below zero Macd Signal Line Any Macd crossing signal from below (Bullish) Macd crossing signal from above (Bearish) Macd is above signal line Macd is below signal line Macd Signal >0 Macd Signal < 0 PSar Any PSar Above Price (Bearish) PSar Below Price (Bullish) pSAR Crossing Above Price (Bearish) pSAR Crossing Below Price (Bullish) Technical Score Any Above 90 Above 80 Above 70 Above 60 Above 50 Above 40 Below 40 Below 30 Below 20 Below 10 Swing Move Any Swing UP (Bullish) Swing DOWN (Bearish)

Price Spike (Last 5 min) Any Up Up 0.25% Up 0.5% Up 1% Up 1.5% Up 2% Up 3% Up 5% Up 10% Up 15% Up 20% Down Down 0.25% Down 0.25% Down 0.5% Down 1% Down 1.5% Down 2% Down 3% Down 5% Down 10% Down 15% Down 20% Volume Spike (Last 5 min) Any Over 1x Over 2x Over 3x Over 4x Over 5x Over 10x Below 1x Below 2x Below 3x Below 5x Below 10x Support/Resistance (Pivot) Any Price move above Pivot Point Price move below Pivot Point Price move above R1 Price move below R1 Price move above R2 Price move below R2 Price move below S1 Price move above S1 Price move below S2 Price move above S2 Price above Pivot Point Price below Pivot Point Price above R1 Price below R1 Price above R2 Price below R2 Price below S1 Price above S1 Price below S2 Price above S2 Tech Meter Any Bullish 1 Bearish 1 Bullish 2 Bearish 2 Open Interest(OI) Any OI Increased OI Decreased Significant Addition in OI Significant Reduction in OI OI increased between 1% to 5% OI increased between 5% to 10% OI increased between 10% to 30% OI increased between 30% to 50% OI increased above 5% OI increased above 15% OI increased above 25% OI increased above 50% OI decreased between 1% to 5% OI decreased between 5% to 10% OI decreased between 10% to 30% OI decreased between 30% to 50% OI decreased above 5% OI decreased above 15% OI decreased above 25% OI decreased above 50%

Plus/Minus DI Any Plus Di is above Minus Di minus Di is above Plus Di Plus Di crossing Minus Di from Below (Bullish) Plus Di crossing Minus Di from Above (Bearish) Plus Di < 10 Minus Di < 10 Plus Di between 15 and 20 Plus Di between 20 and 25 Plus Di between 25 and 30 Plus Di between 35 and 40 Plus Di between 45 and 50 Plus Di between 30 and 60 Minus Di between 15 and 20 Minus Di between 20 and 25 Minus Di between 25 and 30 Minus Di between 35 and 40 Minus Di between 45 and 50 Minus Di between 30 and 60 Plus Di between 10 and 20 Plus Di between 20 and 30 Plus Di between 30 and 40 Plus Di between 40 and 50 Plus Di between 50 and 60 Plus Di between 60 and 70 Plus Di between 70 and 80 Minus Di between 10 and 20 Minus Di between 20 and 30 Minus Di between 30 and 40 Minus Di between 40 and 50 Minus Di between 50 and 60 Minus Di between 60 and 70 Minus Di between 70 and 80 High/Low Analysis Any Low above Previous Candle Close Low below Previous Candle Close Low above Previous Candle Low Low below Previous Candle Low (Bearish) High above Previous Candle High (Bullish) High below Previous Candle High High above Previous Candle Close High below Previous Candle Close LTP above Previous Candle High(Bullish) LTP below Previous Candle Low (Bearish) LTP above Previous Day High (Bullish) LTP below Previous Day Low (Bearish) Open above Previous Candle High Open below Previous Candle Low Open above Previous Candle Close Open below Previous Candle Close Open same as Current High Open same as Current Low High formed in current candle Low formed in current candle High above Previous Day High Low below Previous Day Low High breakout after Low Breach Low Breakdown after High Breach Stock Price Any Below Rs 5 Between Rs 5-10 Between 10-50 Between 50-100 Between 100-200 Between 200-500 Between 200-800 Between 200-3000 Between 500-1000 Between 1000-3000 Above 3000 Between Rs 10-100 Above Rs 40 Above Rs 100 Above Rs 500 Below Rs 500 Between Rs 500-3000 Below Rs 1000 Candle type Any Green Candle Red Candle Current Candle Doji Inside Bar Outside Bar Indecisive Decisive (Bullish) Decisive (Bearish) Spinning Top Marubuzo (Bullish) Marubuzo (Bearish) Day Volume Any More than 10 Lakhs more than 5 Lakhs more than 1 Lakh more than 50000 less than 50000 less than 1 Lakhs less than 5 Lakhs less than 10 Lakhs

Gap Up Down Analysis Any Gap Up Gap Up > 1% Gap Up > 2% Gap Up > 3% Gap Up > 4% Gap Up > 5% Gap Down Gap Down > 1% Gap Down > 2% Gap Down > 3% Gap Down > 4% Gap Down > 5% Stoch (14,3,3) Any OverBought (> 90) OverBought (> 80) Above 75 Above 70 Above 65 Above 60 Above 50 Above 30 Above 20 Below 80 Below 75 Below 70 Below 40 Below 30 Below 25 OverSold (< 20) OverSold (< 10) Between 20 and 80 Between 30 and 70 Between 40 and 60 Below 30 and increasing Above 70 and decreasing STOCH %K Increasing STOCH %K Decreasing Crossed above 20 (Bullish) Crossed above 30 Crossed above 40 Crossed above 50 Crossed above 60 Crossed above 70 Crossed above 80 Crossed below 20 Crossed below 30 Crossed below 40 Crossed below 50 Crossed below 60 Crossed below 70 Crossed below 80 (Bearish) SlowK crossing SlowD from below (Bullish) SlowK crossing SlowD from above (Bearish) SlowK > SlowD and SlowK and SlowD b/w 20 and 50 SlowK < SlowD and SlowK and SlowD b/w 50 and 80 SlowK > SlowD and SlowK and SlowD b/w 20 and 80 SlowK < SlowD and SlowK and SlowD b/w 20 and 80 SlowK < SlowD SlowK > SlowD SlowK within 1% of SlowD Market Cap Any Greater than 5000 Crores Greater than 1000 Crores Greater than 500 Crores Greater than 300 Crores Greater than 100 Crores Lesser than 5000 Crores Lesser than 1000 Crores Lesser than 500 Crores Lesser than 100 Crores Lesser than 50 Crores Lesser than 25 Crores Fractal Any Price crossing Up Fractal from below (Bullish) Price crossing Down Fractal from above (Bearish) Price between Up and Down Fractal Price above Up Fractal Price below Down Fractal Super Trend Any Price above STI Price below STI Price crosses above STI (Bullish) Price crosses below STI (Bearish)

CandleStick Patterns Any Matching Any Bullish Pattern (Bullish Reversal) Matching Any Bullish Pattern (Bullish Reversal Trend Verified) Matching Any Bearish Pattern (Bearish Reversal) Matching Any Bearish Pattern (Bearish Reversal Trend Verified) Dark Cloud Cover Bearish Dark Cloud Cover Bearish (Trend Verified) Evening Doji Star Bearish Evening Doji Star Bearish (Trend Verified) Evening Star Bearish Evening Star Bearish (Trend Verified) Morning Doji Star Bullish Morning Doji Star Bullish (Trend Verified) Morning Star Bullish Morning Star Bullish (Trend Verified) Three Black Crows Bearish Three Black Crows Bearish (Trend Verified) Three White Soldiers Bullish Three White Soldiers Bullish (Trend Verified) Doji Star Bearish Doji Star Bearish (Trend Verified) Doji Star Bullish Doji Star Bullish (Trend Verified) Engulfing Bearish Engulfing Bearish (Trend Verified) Engulfing Bullish Engulfing Bullish (Trend Verified) Harami Cross Bearish Harami Cross Bearish (Trend Verified) Matching Low Bullish Matching Low Bullish (Trend Verified) Piercing Line Bullish Piercing Line Bullish (Trend Verified) Hammer Or Dragonfly Doji Bullish Hammer Or Dragonfly Doji Bullish (Trend Verified) Hanging Man Or Dragonfly Doji Bearish Hanging Man Or Dragonfly Doji Bearish (Trend Verified) Harami Bearish Harami Bearish (Trend Verified) Harami Bullish Harami Bullish (Trend Verified) Harami Cross Bullish Harami Cross Bullish (Trend Verified) Inverted Hammer Or Gravestone Doji Bullish Inverted Hammer Or Gravestone Doji Bullish (Trend Verified) Shooting Star Or Gravestone Doji Bearish Shooting Star Or Gravestone Doji Bearish (Trend Verified) Evening Doji Star Bullish Evening Doji Star Bullish (Trend Verified) Maribozu Bullish Maribozu Bearish Belt Hold Bullish Belt Hold Bearish Tri Star Bullish Tri Star Bearish Long Legged Bullish Long Legged Bearish Abandoned Baby Bullish Abandoned Baby Bearish Breakaway Bullish Breakaway Bearish Bullish Kicker Bearish Kicker Bullish White Soldier Bearish Black Crow Price - VWAP Any LTP above VWAP LTP below VWAP LTP croosing above VWAP LTP crossing below VWAP LTP Analysis Any LTP above Previous Candle High (Bullish) LTP below Previous Candle Low (Bearish) LTP above Previous Day High (Bullish) LTP below Previous Day Low (Bearish) LTP below Previous Day High LTP above Previous Day Low Ltp above Prev. Candle Body Ltp below Prev. Candle Body Ltp (2% or more) lower from Day High Ltp (3% or more) lower from Day High Ltp (4% or more) lower from Day High Ltp (5% or more) lower from Day High Ltp (2% or more) higher from Day Low Ltp (3% or more) higher from Day Low Ltp (4% or more) higher from Day Low Ltp (5% or more) higher from Day Low Ltp Above Day Open Ltp Below Day Open Prev. Day CS Patterns Any Matching Any Bullish Pattern Matching Any Bearish Pattern Dark Cloud Cover Bearish Evening Doji Star Bearish Evening Star Bearish Morning Doji Star Bullish Morning Star Bullish Three Black Crows Bearish Three White Soldiers Bullish Doji Star Bearish Doji Star Bullish Engulfing Bearish Engulfing Bullish Harami Cross Bearish Matching Low Bullish Piercing Line Bullish Hammer Or Dragonfly Doji Bullish Hanging Man Or Dragonfly Doji Bearish Harami Bearish Harami Bullish Harami Cross Bullish Inverted Hammer Or Gravestone Doji Bullish Shooting Star Or Gravestone Doji Bearish Evening Doji Star Bullish Maribozu Bullish Maribozu Bearish Prev. Day Divergence Any Matching Any Positive Divergence Matching Any Classical Positive Divergence Matching Any Hidden Positive Divergence Matching Any Negative Divergence Matching Any Classical Negative Divergence Matching Any Hidden Negative Divergence Verified RSI Classical Positive Divergence Verified RSI Classical Negative Divergence Verified RSI Hidden Positive Divergence Verified RSI Hidden Negative Divergence Verified MFI Classical Positive Divergence Verified MFI Classical Negative Divergence Verified MFI Hidden Positive Divergence Verified MFI Hidden Negative Divergence Verified OBV Classical Positive Divergence Verified OBV Classical Negative Divergence Verified OBV Hidden Positive Divergence Verified OBV Hidden Negative Divergence Verified MACD Classical Positive Divergence Verified MACD Classical Negative Divergence Verified MACD Hidden Positive Divergence Verified MACD Hidden Negative Divergence Verified WilliamR Classical Positive Divergence Verified WilliamR Classical Negative Divergence Verified WilliamR Hidden Positive Divergence Verified WilliamR Hidden Negative Divergence Verified CCI Classical Positive Divergence Verified CCI Classical Negative Divergence Verified CCI Hidden Positive Divergence Verified CCI Hidden Negative Divergence Verified Stoch Classical Positive Divergence Verified Stoch Classical Negative Divergence Verified Stoch Hidden Positive Divergence Verified Stoch Hidden Negative Divergence

Misc Any Open above Previous Candle High Open below Previous Candle Low Open above Previous Candle Close Open below Previous Candle Close Low above Previous Candle Low High below Previous Candle High Ltp (2% or more) lower from Day High Ltp (3% or more) lower from Day High Ltp (4% or more) lower from Day High Ltp (5% or more) lower from Day High Ltp (2% or more) higher from Day Low Ltp (3% or more) higher from Day Low Ltp (4% or more) higher from Day Low Ltp (5% or more) higher from Day Low Open above Prev. Candle Body Open below Prev. Candle Body Price >5 EMA > 20 EMA 20 EMA > 5 EMA > Price 5 EMA > Price > 20 EMA Price >5 EMA > 50 EMA 50 EMA > 5 EMA > Price 5 EMA > Price > 50 EMA Price >20 EMA > 50 EMA 50 EMA > 20 EMA > Price 20 EMA > Price > 50 EMA 5 EMA < 20 EMA < Price Price < 20 EMA < 5 EMA 5 EMA < Price < 20 EMA 5 EMA < 50 EMA < Price Price < 50 EMA < 5 EMA 5 EMA < Price < 50 EMA 20 EMA < 50 EMA < Price Price < 50 EMA < 20 EMA 20 EMA < Price < 50 EMA ADX > Plus Di ADX > Minus Di Plus Di crossing Minus Di from Below (Positive) Plus Di crossing Minus Di from Above (Negative) Previous Tick was Green Candle Previous Tick was Red Candle Previous Tick was Doji Candle High is below bollinger middle Band Low is above bollinger middle Band Close is below bollinger middle Band Close is above bollinger middle Band Inside Bar Outside Bar ADX reversing Up ADX reversing Down MACD reversing Up MACD reversing Down StochK reversing Up StochK reversing Down StochD reversing Up StochD reversing Down RSI reversing Up RSI reversing Down Current candle volume > Previous Candle Volume Current candle volume < Previous Candle Volume STOCH %K Increasing STOCH %K Decreasing STOCH %D Increasing STOCH %D Decreasing MFI Increasing MFI Decreasing William%R Increasing William%R Decreasing CCI Increasing CCI Decreasing ADX Increasing ADX Decreasing RSI Increasing RSI Decreasing SlowK crossing SlowD from below (Bullish) SlowK crossing SlowD from above (Bearish) Indecisive Decisive (Bullish) Decisive (Bearish) Weekly Pivot Any Price above Weekly Pivot Point Price below Weekly Pivot Point Price above Weekly Support 1 Price below Weekly Support 1 Price above Weekly Support 2 Price below Weekly Support 2 Price above Weekly Resistance 1 Price below Weekly Resistance 1 Price above Weekly Resistance 2 Price below Weekly Resistance 2 Monthly Pivot Any Price above Monthly Pivot Point Price below Monthly Pivot Point Price above Monthly Support 1 Price below Monthly Support 1 Price above Monthly Support 2 Price below Monthly Support 2 Price above Monthly Resistance 1 Price below Monthly Resistance 1 Price above Monthly Resistance 2 Price below Monthly Resistance 2 Monthly Returns Any Low -50% or More Low -30% or More Low -20% or More Low -10% or More Monthly Low (0 to -10%) Monthly High (0 to 10%) High 10% or More High 20% or More High 30% or More High 50% or More is Up is Down Yearly Returns Any Low -50% or More Low -30% or More Low -20% or More Low -10% or More Yearly Low (0 to -10%) Yearly High (0 to 10%) High 10% or More High 20% or More High 30% or More High 50% or More is Up is Down

%B Any %B between 20 and 60 %B between 40 and 60 %B between 20 and 50 %B between 50 and 80 ROC Any Roc5 crossing above 0 Roc5 crossing below 0 Roc5 > 0 Roc5 < 0 Roc5 Increasing from Last Candle Roc5 Decreasing from Last Candle TC Momentum IndicatorNEW Any Greater than 10 (Highly overbought) Greater than 8 (Overbought) Greater than 6 (Moderate Overbought) Less than -10 (Highly Oversold) Less than -8 (Oversold) Less than -6 (Moderate Oversold) Between 4 and -4 (Fair value) TC BandNEW Any Special Bullish Breakout Special Bearish Breakdown Price above TC Upper Band Price below TC Lower Band Bullish Breakout Bearish Breakdown TC Positional BandNEW Any Buy Signal Sell Signal

ADX Misc Any ADX > 25 ADX > 30 ADX > 40 ADX > 50 ADX > 60 ADX > 65 ADX between 15 and 20 ADX between 20 and 25 ADX > Plus Di ADX > Minus Di ADX < Plus Di ADX < Minus Di Plus Di crossing Minus Di from Below (Positive) Plus Di crossing Minus Di from Above (Negative) ADX Increasing ADX Decreasing ADX reversing Up ADX reversing Down Plus Di > 25 Minus Di > 25 ReadyMade Set-Ups Any Bullish Trending Stock Bearish Trending Stocks Bullish Pattern Stocks Bearish Pattern Stocks Retracement Positional Buy Retracement Positional Sell Potential Support Potential Resistance Intraday Potential Breakout Intraday Bearish Intraday Bullish Potential Breakout Ichimoku Trend Any Kumo Bullish (Senkou Span A > Span B) Kumo Bearish (Senkou Span A < Span B) Kumo Bullish twist (Senkou Span A crosses above Span B) Kumo Bearish twist (Senkou Span A crosses below Span B) Price > Kumo Top Price < Kumo Bottom Price is within Kumo Cloud SuperTrend crossing Above Kumo Top SuperTrend crossing Below Kumo Bottom SuperTrend is within Kumo Cloud Ichimoku Crossovers Any Tenkan Sen crossing above Kijun Sen (Bullish) Tenkan Sen crossing below Kijun Sen (Bearish) Price crossing above Kumo Top (Bullish) Price crossing below Kumo bottom (Bearish) Ichimoku Chikou Span Any Chikou Sen crossing above Price (Bullish) Chikou Sen crossing below Price (Bearish) Chikou Sen > Price Chikou Sen < Price Chikou Sen > SSA Chikou Sen < SSA Chikou Sen > SSB Chikou Sen < SSB

Ichimoku Kijun-Sen Any Price > Kijun-Sen Price < Kijun-Sen Price crossing above Kijun-Sen (Bullish) Price crossing below Kijun-Sen (Bearish) TenkanSen Any Price > Tenkan-Sen Price < Tenkan-Sen Price crossing above Tenkan-Sen Price crossing below Tenkan-Sen TenkanSen - KijunSen Any Tenkan-Sen > Kijun-Sen Tenkan-Sen < Kijun-Sen Tenkan Sen crossing above Kijun Sen (Bullish) Tenkan Sen crossing below Kijun Sen (Bearish) TenkanSen KijunSen vs Cloud Any Tenkan-Sen and Kijun-Sen above Cloud Tenkan-Sen and Kijun-Sen below Cloud Tenkan-Sen and Kijun-Sen within Cloud Ichimoku Misc Filters Any Kijunsen and Tenkansen Flat Tenkan Sen Flat and cutting across candle Kijun Sen Flat and cutting across candle SSB Flat and cutting across candle Tenkan Sen Flat and within 1ATR from candle high Tenkan Sen Flat and within 1ATR from candle low Kijun Sen Flat and within 1ATR from candle high Kijun Sen Flat and within 1ATR from candle low SSB Flat and within 1ATR from candle high SSB Flat and within 1ATR from candle low SSB Flat and within 1ATR from candle close SSB Flat and within 0.5ATR from candle close

TC Volume Indicator Any TCVI > TCVS TCVI > 0 TCVI < 0 TCVS > 0 TCVS < 0 TCVI > 0 and TCVS > 0 TCVI < 0 and TCVS < 0 TCVI > 2* TCVS > 0 TCFL Cloud Any Price Above TCFL Cloud Price Below TCFL Cloud Price within TCFL Cloud Price within 1 atr of above cloud Price within 1 atr of below cloud Prev. Candle Type Any Green Candle Red Candle Current Candle Doji Heikin Ashi Any Heikin Ashi Open = Heikin Ashi High Heikin Ashi Open = Heikin Ashi Low

Enable Auto Submit

Explore results across different time framesNEW

My Cockpit

My Cockpit Help

Help Markets

Markets FO Analysis

FO Analysis Interactive Charts

Interactive Charts  Misc Charts

Misc Charts Customizable Tools

Customizable Tools Patterns, Divergence, Calculators

Patterns, Divergence, Calculators BackTesting Tools

BackTesting Tools EOD Analysis Tools

EOD Analysis Tools Live Options Analysis

Live Options Analysis Technical Workshops

Technical Workshops AutoPilot - Trading

AutoPilot - Trading